In this article, we will explore the fundamental aspects of NFT collections, the challenges encountered by their creators, and potential solutions to these challenges. The focus will be on examining the issues that can arise during the creation, promotion, and management of NFT collections, as well as strategies to maximize their market potential.

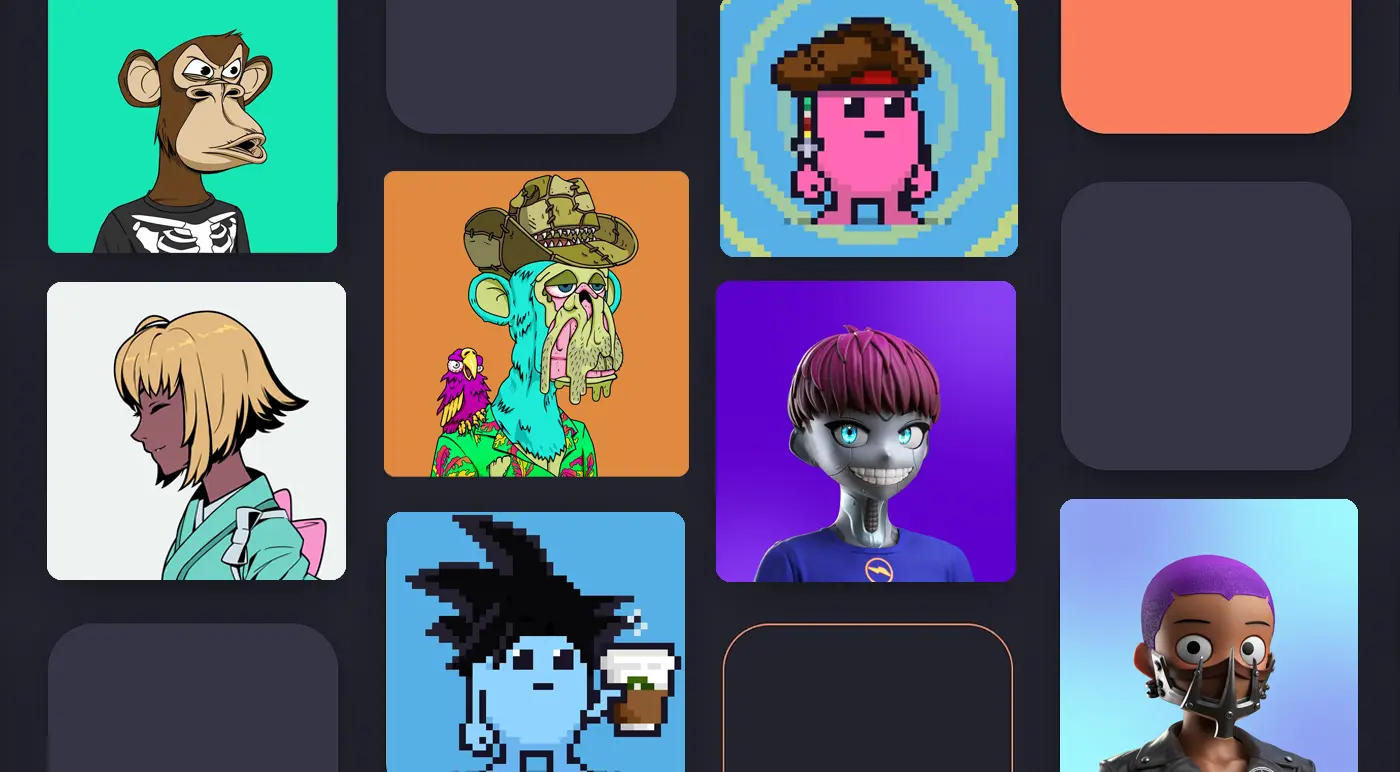

During the creation of images for an NFT collection, numerous problems can arise. For instance, artists working on NFT image creation have been caught using pre-existing material from the internet or engaging in partial replication of existing collections.

Creating high-quality art that simultaneously serves as the face of the collection's brand, is recognizable, visually appealing, and suitable for partnerships can be extremely challenging. It requires the art to be unique and of exceptional quality.

For example, these are 2 collections from the same team (Azuki), the art on the left is the OG collection, the art on the right is the Gen2 Elementals collection.

Utility

Currently, the use of NFTs is primarily limited to a few established methods, namely:

What is the purpose of NFT staking?

NFT staking helps reduce the number of NFTs in active circulation and decreases the supply available for sale on marketplaces. This reduction in supply, combined with sustained demand, can lead to price appreciation.

The problem

The main issue lies in the fact that NFTs themselves do not inherently provide benefits, bonuses, or privileges. You only receive these rewards for owning the NFT and refraining from selling it.

Therefore, the goal of collections is to retain the user's attention for as long as possible, ensuring that the community, actions, and other benefits they receive are worth the money spent on NFTs.

Successful examples

Yuga Labs initially hinted at the release of the latest Bored Ape Yacht Club (BAYC) merchandise on March 25th 2022 through their Instagram page. The official BAYC Twitter account later confirmed the upcoming sale, emphasizing that only holders would have the opportunity to purchase the merch using APEcoin, the project's native token.

This announcement showcased BAYC's unique approach. While some NFT projects accept Ethereum (ETH) or even USD for their merchandise, none have made their own ecosystem token the exclusive payment option. This decision sets BAYC apart, highlighting its influential status within the NFT community. However, it seems that introducing APEcoin payments also introduced some complexities to the merch drop.

Airdrop Bored Ape Kennel Club each cholera original collection in June 2021.

Airdrop of APE tokens in March 2022 for NFT holders from the BAYC and MAYC collections.

The tokens went to the holders of the BAYC and MAYC NFT collections. Owners of copies of the first collection received 10,094 APEs or about $80,000 each, owners of the second collection received 2,042 APEs or about $16,400.

At NFT conferences such as NFT NYC or NFT Paris, successful creators of major collections serve as speakers. This provides NFT holders with the opportunity to access a private lounge, where they can personally engage with developers and enjoy a pleasant time.

Upon purchasing an NFT, users can join the project's Discord server, verify their wallet for ownership of the collection's NFT, and gain a role granting access to private channels reserved for holders. A closed community creates a network for networking and coworking, as the holders can be people from completely different fields of employment who can help each other to some extent, communicate, launch projects together, or simply spend time together. This is a great way to find like-minded individuals with whom you can continue your journey in the world of web3.

The main problem may be that the project team doesn't pay enough attention to and doesn't actively engage with the community. They believe that people will organize themselves, but the project team is the main driving force behind the community.

In most cases, NFT projects generate revenue through two main avenues:

Additionally, NFT projects may explore other revenue-generating opportunities, such as collaborations, partnerships, sponsorships, or licensing their intellectual property. These additional avenues can contribute to the overall financial sustainability of the project.

The main challenge arises when a project fails to establish itself among the top collections, resulting in insufficient royalty income to sustain the project, compensate the team's efforts, and further develop the envisioned ideas.

As a result, many projects, without devising an original approach to refine their business structure, simply launch a new Gen 2 collection and gather funds through minting. Alternatively, they introduce a token where a portion of the total supply is allocated to the team and project development. This allows them to secure additional resources to support their endeavors.

It is also worth noting the importance of promoting your brand in web2 since the potential audience that can be interested in your project is hundreds of times larger than the web3 audience. This presents excellent prospects for developing your business structure.

Pudgy Penguins

On May 18, the Pudgy Penguins NFT Twitter account released a thrilling video revealing the introduction of Pudgy Penguin merchandise. The Pudgy Penguins made their debut on Amazon and within 48 hours, they sold over 20,000 figurines, generating an impressive $500,000 in sales for their "Phygital" goods. Holders of Pudgy Penguin NFTs received royalties every time someone purchased a toy associated with their NFT.

This achievement marked a significant milestone as the first-ever mass-market product line, licensed by the community, from a Web3 brand. It showcases the collaborative and innovative spirit of the Web3 community.

DeGods

DeGods, a Solana-based NFT project, made a significant acquisition in the world of basketball. They purchased a basketball team within Ice Cube's BIG3 association for $625,000. The purchase was made by the DeGods DAO, which acquired 25 'fire-level' NFTs representing ownership stakes in a team called Killer 3s.

The DeGods DAO's acquisition specifically involved purchasing all 25 of the highly sought-after 'fire-level' NFT ownership stakes in the Killer 3s team. Each NFT was priced at $25,000, resulting in a total transaction value of approximately $625,000.

In reality, the NFT market is thriving, and the community enthusiastically supports worthy projects when the team diligently and meticulously approaches every aspect, from the artwork and the establishment of multiple revenue streams for natural and seamless project development.

Furthermore, it has become relatively easy to distinguish a dubious project from a worthy one. If the project team doesn't put effort into creating high-quality artwork and their roadmap consists of typical Staking, Token, Merch, etc., then it is likely that the team aims to raise funds and follow a proven script to launch a token, Gen2 collection, ultimately dooming the collection to a slow death.

Therefore, pay attention to the details because it is precisely based on how much attention the project team devotes to the little things that we can make conclusions about the project's prospects.