World Liberty Financial (WLF) aims to provide seamless access to third-party DeFi applications and digital wallet providers, enabling users to acquire, hold, and transfer stablecoins and other non-security digital assets. The platform integrates liquidity pools, allowing users to earn yields by supplying stablecoins or borrowing using their digital assets as collateral.

This article explores the core components of the World Liberty Financial ecosystem, including its governance token (WLFI), stablecoin (USD1), protocol structure, wallets and holdings, notable affiliations, and the high-profile individuals involved.

The WLFI token, central to the World Liberty Financial (WLF) ecosystem, is designed to facilitate governance and operational activities within the platform. WLFI tokens grant holders the right to vote on certain protocol matters, including setting new parameters and making strategic decisions regarding the platform’s development.

Although WLFI facilitates governance, it is not a DAO token, and World Liberty Financial is not a decentralized autonomous organization. Instead, WLF is a Delaware-registered non-stock corporation. It has a board of directors and no shareholders – only members, currently limited to the board itself.

WLFI holders:

All WLFI tokens are non-transferable and locked indefinitely in wallets or smart contracts. They can only be unlocked via a governance procedure compliant with applicable law. As such, WLFI tokens are not expected to be listed on any exchanges in the foreseeable future.

USD1 is a fiat-backed stablecoin launched in April 2025 by World Liberty Financial. It is designed to maintain a 1:1 peg with the U.S. dollar.

In May 2025, MGX, a state-backed firm led by Tahnoun bin Zayed Al Nahyan of the Abu Dhabi royal family, announced plans to use $2 billion worth of USD1 to finance a deal involving the cryptocurrency exchange Binance.

This deal raised concerns about potential conflicts of interest, particularly regarding the political affiliations of those involved.

As of April 30, 2025, USD1 had reached a circulation of $2.1 billion, making it one of the fastest-growing stablecoins.

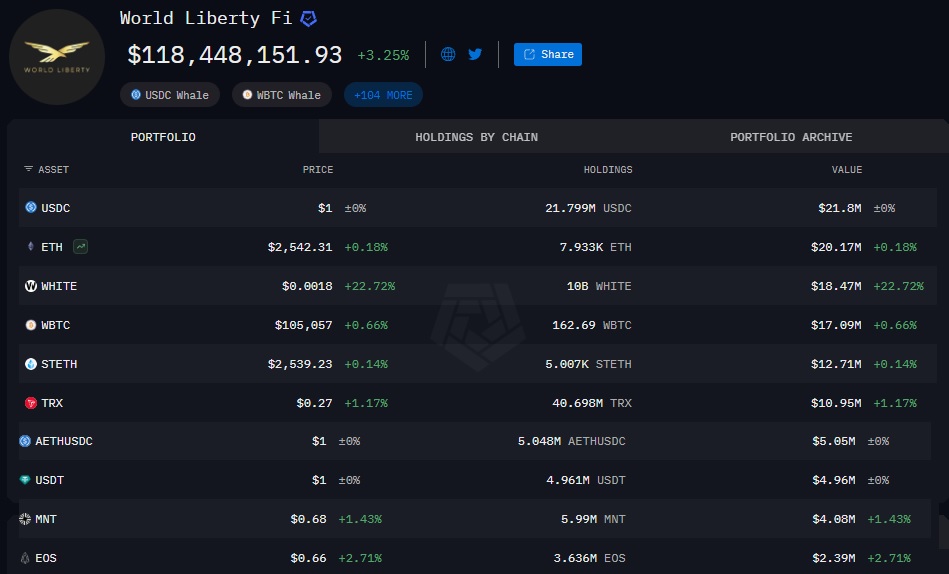

Users can monitor wallet activity, asset transfers, purchases, and sales using the link — World Liberty Financial holdings

In this article, only holdings above $100,000 are highlighted. Double-check whether it was a purchasing order or if it was sent to the wallet by a random person!

WLF has garnered attention largely due to its association with the Trump family and broader political implications. Roles include:

These associations have boosted the platform’s visibility, particularly during Trump’s 2024 presidential campaign.

Revenue generated by the protocol is not distributed to token holders. Instead, it is allocated as follows:

This structure solidifies the project’s financial control under Trump-affiliated and founder-led entities.

The real controllers and decision-makers of World Liberty Financial are:

Both serve as sole signers of the protocol’s multi-signature wallet, granting them exclusive control over WLF’s financial operations.

Chinese entrepreneur Justin Sun is the most prominent buyer of WLFI tokens, having reportedly invested at least $75 million. He also serves as an advisor to World Liberty Financial.

In February 2025, shortly after Trump’s second presidential term began, the SEC reportedly backed off an investigation into Sun’s businesses.

Shortly thereafter, Steve Witkoff announced that USD1 would be integrated into Tron, Sun’s blockchain network.

This deepening relationship between Sun and Trump-linked financial entities has raised additional conflict of interest concerns.

Despite its high-profile backers and market traction, the WLFI token carries several significant risks:

These factors combine to create a high-risk profile for WLFI, making it unsuitable for investors seeking equity-like returns or short-term liquidity.

World Liberty Financial stands at the crossroads of politics, cryptocurrency, and governance innovation. While its ecosystem offers novel ways to engage in DeFi, its governance structure, legal setup, and revenue model strongly benefit the founders and affiliated entities, but not WLFI token holders!

For now, the project’s long-term viability remains tightly tied to its political associations and the evolving regulatory landscape.